As your state registered investment adviser firm completes its Form ADV Annual Amendment, it’s important not to forget that many state securities regulators also require a state registered investment adviser firm to submit annual financial statements and/or other documents (e.g., proof of continued coverage of a surety bond, investment advisory client agreement if material changes) directly to the state securities regulator (outside of the IARD/CRD system).

Requirements vary significantly among states – some state securities regulators require all state registered investment adviser firms filed in the state to submit an annual financial statement while other state securities regulators may only require the submission of an annual financial statement if the investment adviser firm has a principal place of business in the state, maintains investment discretion or is deemed to have custody of client assets.

These annual submissions (outside of the IARD/CRD system) of the financial statement and/or other documents to a home state securities regulator are often due within 90 days of the end of an investment adviser’s fiscal or calendar year end, however, some state securities regulators utilize a different schedule such as a December 31 deadline.

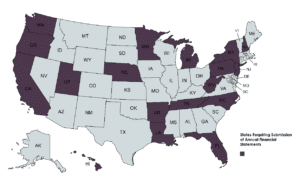

In particular, RIA Compliance Consultants is aware of the following states which require a state registered investment adviser firm to make such annual financial statement and other document submissions outside of the IARD/CRD system: Arkansas, California, Florida, Hawaii, Louisiana, Michigan, Minnesota, Nebraska, New Hampshire, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Tennessee, Utah, Washington, and West Virginia.

This should not be considered an exhaustive listing of state securities regulators with such requirements. If your investment adviser firm is state registered, we recommend that you immediately review any communication that you received recently from your state securities regulator on this subject or contact your home state securities regulator to confirm whether there are any annual submissions (outside of the IARD/CRD system) such as annual financial statement due for your state registered investment adviser firm. (For investment adviser firms subscribing to RIA Compliance Consultants’ Annual Compliance Program (Bronze – Platinum packages), please check your online subscription account for any shared regulatory guidance.) Once your investment adviser firm has identified the applicable requirements, you should memorialize such requirement in your compliance manual and promptly submit to your state securities regulator any required documents.

Contact Us

If you’d like to learn more about our investment adviser compliance consulting services, please click here to set up an introductory call with RIA Compliance Consultants.

Additional Resources

To view a webinar about filing your Form ADV Annual Updating Amendment please click here.

To have RIA Compliance Consultants assist you with filing your Form ADV Annual Updating Amendment please click here.

RIA Express – Compliance Manual Drafter

Annual Financial Report – Cover Letter for California

Related Posts

Regulatory Reminder – Submission of Annual Financial Statements in Certain States – 3/20/2020

Tip #5 for IARD Renewals – Check for State’s Miscellaneous Requirements – Annual Financials – 12/2/2019

Nebraska State-Registered Investment Adviser Renewal Requirements for 2020 – 11/8/2019

An Investment Adviser Firm’s IARD Renewals

Posted by RCC

Labels: Annual Amendment, California Investment Advisor, Florida Investment Advisor, Hawaii Investment Advisor, IARD, Investment Advisory Client Contracts, Louisiana Investment Advisor, Minnesota Investment Advisor, Nebraska, New York investment Advisor, North Carolina Investment Adviser, Pennsylvania Investment Advisor, Tennessee, Utah Investment Advisor, Washington Investment Advisor

Tagged: California Investment Adviser, Financial Statements, Florida Investment Adviser, Hawaii Investment Adviser, Louisiana Investment Adviser, Michigan Investment Adviser, Minnesota Investment Adviser, Nebraska Investment Adviser, New Hampshire Investment Adviser, New Jersey Investment Adviser, New York Investment Adviser, North Carolina Investment Adviser, Oregon Investment Adviser, Pennsylvania Investment Adviser, Tennessee Investment Adviser, Utah Investment Adviser, Washington Investment Adviser, West Virginia Investment Adviser