Apply for the Scholarship

Apply for the Scholarship

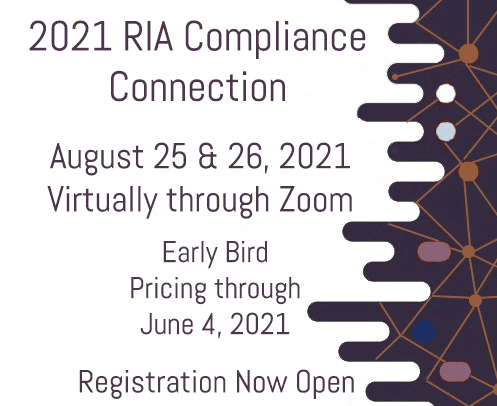

For the second year in a row, RIA Compliance Consultants will award up to three scholarships to undergraduate or graduate students interested in compliance, personal finance or investment management. This scholarship is for purposes of attending the 2021 RIA Compliance Connection, an investment adviser compliance conference sponsored by RIA Compliance Consultants, Inc. RIA Compliance Connection will take place virtually through Zoom.com on Wednesday, August 25 and Thursday, August 26, 2021.

2021 Compliance Conference Registration Now Open

March 31, 2021

Join us virtually on August 25 and 26, 2021 for RIA Compliance Connection, our annual Investment Adviser Compliance Conference. RIA Compliance Connection is an opportunity to learn compliance best practices from our Compliance Consultants and other investment adviser compliance professionals.

The U.S. Securities and Exchange Commission (“SEC”) recently announced that during the first half of fiscal year 2021, the SEC has already exceeded previous fiscal year’s record for individual whistleblower awards. Click here for the SEC’s press release.

Texas Securities Board Amends Rules to Harmonize with SEC’s New Accredited Investor Definition

March 29, 2021

On March 21, 2021, the Texas Securities Board adopted several amendments to its rules and regulations for registered investment advisers and other financial institutions, intended to harmonize the state’s rules with the amended definitions of accredited investor and qualified institutional buyer implemented by the Securities and Exchange Commission (“SEC”) in December 2020. Concurrently, the Texas Securities Board adopted additional amendments which affect broker dealers and other financial institutions other than registered investment advisers. A summary of the most recent changes adopted by the Texas Securities Board is available here.

SEC Updates Form ADV Part 3/CRS FAQs for Investment Advisers

March 22, 2021

On March 5, 2021, the U.S. Securities and Exchange Commission (“SEC”) added three new questions and answers to its website page with Frequently Asked Questions (“FAQs”) on the Form CRS/Form ADV Part 3 for SEC registered investment adviser serving retail investors. The first new Q&A addresses situations in which an investment adviser or broker dealer with a Form CRS/Form ADV Part 3 filing obligation is dually registered or affiliated with a firm that does not have a Form ADV Part 3/Form CRS filing obligation. The second and third Q&A clarify when and how an SEC-registered investment adviser or broker dealer must file and disseminate the Form ADV Part 3/Form CRS (also referred to as a “relationship summary”) if material and/or nonmaterial changes have occurred.

SEC Announces 2021 Examination Priorities for RIAs

March 15, 2021

On March 3, 2021, the Division of Examinations (formerly known as the “Office of Compliance Inspections and Examinations”) of the U.S. Securities and Exchange Commission (“SEC”) released its 2021 Examination Priorities, an annual report discussing the Division of Examination’s areas of focus including investment advisers registered with the SEC (“RIAs”) for the coming year. In this report, the Division of Examinations (“Division”) noted that it intends to continue to prioritize examinations of SEC registered investment advisers, broker-dealers, and dually registered or affiliated firms, particularly those that have never been examined or have not been examined recently. In doing so, the Division will emphasize protection of retail investors and those saving for retirement.

SEC Is Focusing on ESG Investing by RIAs

March 05, 2021

The United States Securities and Exchange Commission (“SEC”) made it abundantly clear this week that it will be focusing (i.e., exams and enforcement actions) on ESG investing by investment advisers firms (“RIAs”).