On Thursday, October 22, 2020 at 12:00 PM CDT, RIA Compliance Consultants, Inc. will host a compliance training webinar entitled, “Best Practices to Reduce the Risk of Arbitration and Litigation.” RCC is excited to have representatives from Unitifi and Lockton Affinity serve as panelists on this webinar. Patrick Griffin, an attorney from Kutak Rock, will also serve as a panelist during this discussion.

Investment Advisers Disclosing Disciplinary Events on Form ADV Part 3

September 22, 2020

Intended to be a concise and easily understandable disclosure for retail investors, the United States Securities and Exchange Commission (“SEC”) implemented the Form CRS/Form ADV Part 3 relationship summary to help SEC registered investment advisers provide information to their retail investor clients about the relationships and services the investment adviser firm offers, fees and costs that retail investors will pay, specified conflicts of interest and standards of conduct, and disciplinary history. To learn more about the SEC’s requirements of Form CRS/Form ADV Part 3, please see our website page at https://www.ria-compliance-consultants.com/form-adv-part-3-faqs/ .

Compliance Concerns for Private Funds

September 15, 2020

On Thursday, September 24 RIA Compliance Consultants will host a webinar, “Compliance Concerns for Private Funds,” at 12:00 PM CT. During this compliance training webinar, RCC’s Senior Vice-President, Jarrod James, will be joined by Dan McMahon of Koley Jessen to discuss the SEC’s recent Risk Alert entitled SEC’s Observations from Examinations of Investment Advisers Managing Private Funds. We will also discuss the key differences between an Exempt Reporting Adviser filing (ERA) for private fund advisers and full registration as an investment adviser along with the private fund information both filing-types must provide on Form ADV.

NASAA Seeks Input on Investment Adviser Representative Continuing Education Program

September 05, 2020

The North American Securities Administrators Association, Inc. (“NASAA”) is currently seeking input from NASAA members (i.e., state and provincial securities regulators) and other industry professionals, including registered investment advisers and their representatives regarding potential content for classes in its proposed investment adviser representative continuing education program. NASAA intends to utilize survey responses for design and implementation of the proposed IAR continuing education program.

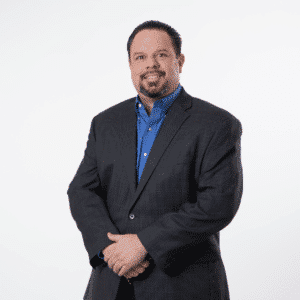

2020 Compliance Professional of the Year

September 01, 2020

RIA Compliance Consultants is pleased to  announce Anthony Woodard as the winner of our 2020 Compliance Professional of the Year! Anthony serves as the Chief Compliance Officer for Prime Capital Investment Advisors, LLC (PCIA). As CCO, his primary objectives are to ensure that PCIA is in compliance with industry regulations, to assess the firm’s exposure to risk, and to create and administer policies that effectively address such risks.

announce Anthony Woodard as the winner of our 2020 Compliance Professional of the Year! Anthony serves as the Chief Compliance Officer for Prime Capital Investment Advisors, LLC (PCIA). As CCO, his primary objectives are to ensure that PCIA is in compliance with industry regulations, to assess the firm’s exposure to risk, and to create and administer policies that effectively address such risks.

SEC Enforcement Action Against an Investment Adviser Over Limiting Wrap to NTF Funds

August 31, 2020

On July 28, 2020, the United States Securities and Exchange Commission (“SEC”) filed an order instituting an enforcement action/administrative cease-and-desist proceeding against an SEC registered investment adviser firm for allegedly failing to disclose material conflicts of interest related to its mutual fund share class selection practices, receipt of revenue sharing, avoidance of transaction fees, receipt of compensation pursuant to Rule 12b-1 under the Investment Company Act of 1940 (“12b-1 fees”), and failure to seek best execution.

SEC Issues Cease and Desist Order Against Dual BD/RIA for Revenue Sharing on Money Market Cash Sweep

August 24, 2020

On August 13, 2020 the United States Securities and Exchange Commission (“SEC”) filed an order instituting administrative cease-and-desist proceedings to a dually registered investment adviser firm/introducing broker-dealer firm for allegedly failing to disclose material conflicts of interest related to its mutual fund share class selection practices, receipt of compensation pursuant to Rule 12b-1 under the Investment Company Act of 1940 (“12b-1 fees”), and money market revenue sharing agreements.

Top 10 Reasons to Attend RIA Compliance Connection 2020

August 11, 2020

Join RIA Compliance Consultants on Wednesday, August 26 and Thursday, August 27 for our RIA Compliance Connection 2020 virtual conference. Don’t miss this opportunity to learn from industry experts, engage with like-minded peers, and connect with the top leaders in the industry all in the name of the best interest of your clients. Need more convincing?

The North American Securities Administrators Association, Inc. (“NASAA”) recently released a white paper detailing the results of a study conducted by its Senior Issues/Diminished Capacity Committee. While many investment adviser firms are increasingly aware of issues related to diminished capacity in clients, NASAA has found that not all registered investment advisers are prepared to identify and address diminished capacity among investment adviser representatives. As part of the study, NASAA surveyed a number of financial institutions and industry professionals including Bryan Hill, President of RIA Compliance Consultants, Inc.

On July 10, 2020, the United States Securities and Exchange Commission (“SEC”) announced proposed amendments to the Form 13F reporting threshold for institutional investment managers. Currently, Section 13F requires institutional investment managers, which includes registered investment advisers, to file a report with the SEC if the institutional investment manager exercises investment discretion over accounts holding certain types of equity securities that have an aggregate fair market value of at least $100 million on the last trading day of any month of any calendar year. The threshold has not been updated since the mid-1970s when the Form 13F was first adopted by the SEC.