Yesterday, the U.S. Securities and Exchange Commission (“SEC”) proposed amendments to the Form PF, the confidential reporting form for certain SEC registered investment advisers to private funds.

New Sample Form: Assignment – Name Change Only – Letter to Client

January 26, 2022

RIA Compliance Consultants recently created a new sample investment adviser form, Assignment – Name Change Only – Letter to Client.

Will Your Investment Adviser’s Use of an Outsourced CCO Survive Regulatory Scrutiny?

January 11, 2022

Although many investment adviser firms desire to outsource the chief compliance officer role to an unaffiliated third-party independent contractor (“Outsourced CCO”), such an arrangement will be scrutinized and could be challenged by the securities regulator as a violation Rule 206(4)-7 or equivalent rule of the state securities regulator depending upon the facts and circumstances.

Maryland Adopts IAR Continuing Education Rule

December 27, 2021

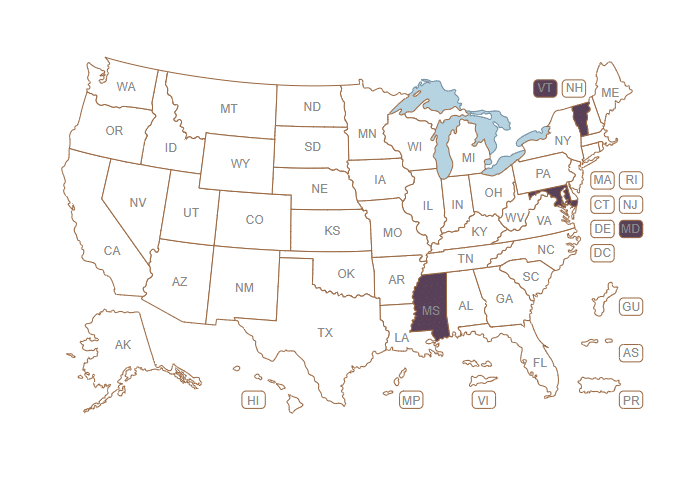

On December 7, 2021, the Maryland Securities Division announced its new investment adviser representative continuing education requirement, joining Mississippi and Vermont to now require investment adviser representatives to complete investment adviser representative continuing education (“IAR CE”). Closely tracking the NASAA’s Model IAR CE Rule and effective for the 2022 calendar year, investment adviser representatives who are registered in Maryland must now complete twelve credit hours of IAR CE on an annual basis. Of those twelve credit hours, six must be completed in “Products and Practices” and six in “Ethics and Professional Responsibilities,” with at least three focusing specifically on ethics.

Investment Advisers Should begin Preparing to Submit their Annual Form ADV Amendment

December 22, 2021

Investment Advisers’ Final Renewal Statements and reports will be available for viewing and printing on January 2, 2022. All registered investment advisers should download and review these reports; Final Renewal Statements will indicate if any additional fees are due and these payments are due by January 22, 2022. Additionally, investment advisers with a fiscal year end of December 31 are encouraged to begin preparing their required Form ADV annual updating amendments.

Investment Advisers’ Final Renewal Statements and reports will be available for viewing and printing on January 2, 2022. All registered investment advisers should download and review these reports; Final Renewal Statements will indicate if any additional fees are due and these payments are due by January 22, 2022. Additionally, investment advisers with a fiscal year end of December 31 are encouraged to begin preparing their required Form ADV annual updating amendments.

Vermont Adopts IAR Continuing Education Rule

December 10, 2021

On December 9, 2021, the Securities Division of the Vermont Department of Financial Regulation announced it had adopted an investment adviser representative continuing education requirement, making it the second state to now require investment adviser representatives to complete investment adviser representative continuing education (“IAR CE”). Closely tracking the NASAA’s Model IAR CE Rule and effective for the 2022 calendar year, investment adviser representatives who are registered in Vermont must now complete 12 credit hours of IAR CE each year.

Deadline for Receipt of Preliminary Renewal Statement Payments Quickly Approaching

December 02, 2021

The deadline for investment advisers to submit their Preliminary Renewal Statement payment is quickly approaching. FINRA must be in receipt of the full payment listed on the Preliminary Renewal Statement by December 13, 2021. Investment advisers with sufficient funds in their Flex-Funding Account to cover the Preliminary Renewal Statement payment will have funds automatically transferred beginning on December 13, 2021 to the Renewal Account to cover total renewal fees owed. Automatic transfers will be conducted every day after December 13, 2021 until the WEB CRD/IARD shuts down for year-end processing on December 27, 2021. Investment advisers that choose to mail in their payments are advised to do so now to avoid delays and to ensure funds are received by the deadline.

We have recently updated our Advertising – Accessibility – Best Practices Checklist to include additional examples of how to make an investment adviser’s website more accessible to individuals with disabilities. This sample form was initially released in July, in conjunction with our complimentary RIA Website Accessibility webinar.

Preliminary Renewal Statement Now Available

November 09, 2021

As of Monday, November 8, 2021, your investment advisor firm can access, via its IARD account, its Preliminary Renewal Statement for the upcoming year. Investment advisor firms are assessed individual registration fees based on the state(s) that the firm is notice filed or registered in and the number of investment advisor representatives and their approved registration statuses. The amount reflected in the Preliminary Renewal Statement is the amount of renewal fees investment advisors must pay in order to maintain active registration for the firm and its investment advisor representatives.